does td ameritrade report to irs

TD Ameritrade does not report this income to the IRS. I use TD Ameritrade Institutional primarily in order to be most familiar with their process forms and procedures.

How To Read Your Brokerage 1099 Tax Form Youtube

Proceeds not reported to the IRS does this mean I dont have to report these proceeds.

. The IRS has updated the 2021 Form 1099-DIV to include two new boxes. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. WKFS and is made available by TD Ameritrade for general reference.

Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years. Web TD Ameritrade does not report this income to the IRS. 123456789 Document ID 11 characters eg.

Posted on March 10 2017 by admin. Have you talked to a tax professional about this. Can you change leverage on XM.

Under the My Accounts list in the left hand column click View e-Documents. Web My TD Ameritrade Tax Statement shows. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative.

Web Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Box 2e - Section 897 ordinary dividends. The topic of this.

Web Understanding Form 1040. The reason is simple. Will TD Ameritrade disappear.

Web The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Web TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. Web What does TD Ameritrade report to IRS.

Required fields are marked Comment. Web TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program. Account Number 9 digits eg.

Intraday data is delayed at least 20 minutes. Can I enter K1 in turbotax and click the IRA for the K1 to do the taxes. My 1099 B shows.

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. Does Ameritrade report to the IRS.

Under the Documents listing locate your T5 and click the related link. There are many custodian banks. Web TDAmeritrade says IRS wants to tax the Schedule K1 in IRA unrelated business taxable income.

Web Steps to access your T5 through online banking. Can XM be trusted. Reference the warning and click the Continue button.

Anything else you want the Accountant to know before I connect you. To retrieve information from their server you will need the following information. No the UBTI is taxable income to the IRA not to you.

TD Ameritrade does not report this income to the IRS. Your email address will not be published. GainsKeeper service and performance reporting is offered and conducted by Wolters Kluwer Financial Services Inc.

3 Supplemental Summary Page A snapshot of the additional information that TD Ameritrade does not report to the Internal Revenue Service IRS is now provided for your reference. View print or save your T5 as required. Leave a Reply Cancel reply.

Web If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500.

Irs Schedule D Form 8949 Guide For Active Traders

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

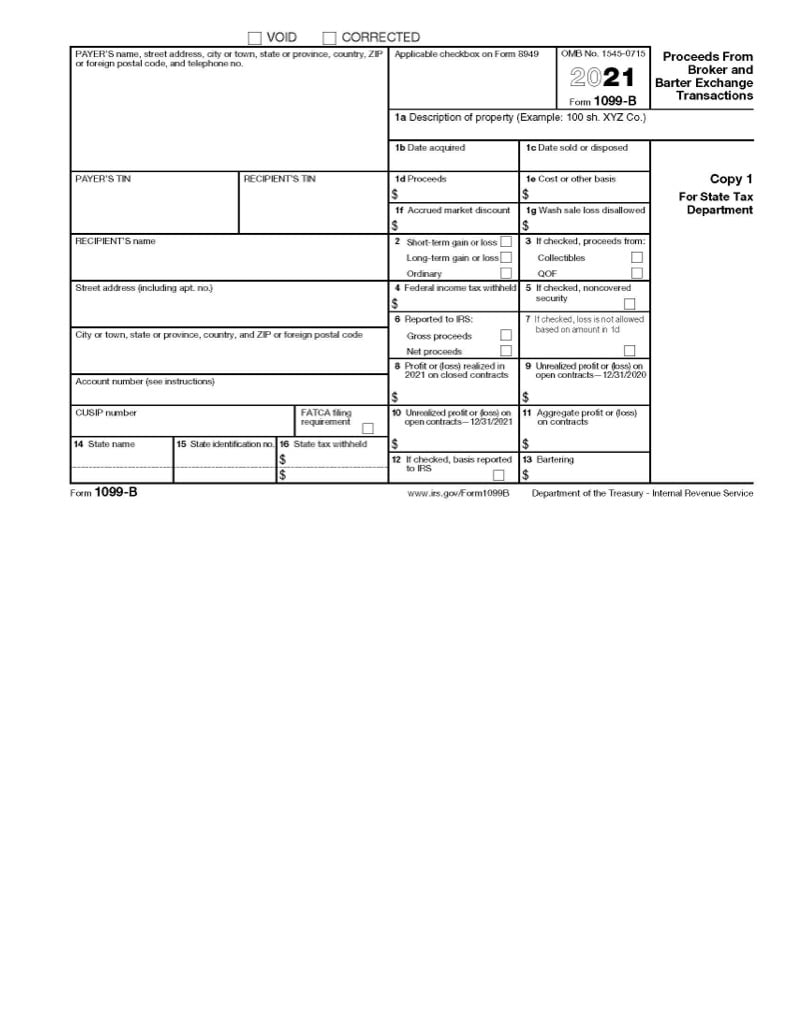

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Report Stock Sales On Taxes Easily How To Report Capital Gains Youtube

Gig Workers Need To Get Ready For Tax Forms Protocol

Form 1099 B Proceeds From Brokered And Bartered Transactions Jackson Hewitt

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Irs Financial Report Available On Irs Gov Youtube

Is Options Trading Reported To Irs

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

8949 Import Transactions Pdi Indicator Or Pdf Attachment 1099b 8949 Scheduled